TYSONS OFFICE

California Intestate Succession: What Happens if There’s No Will?

The loss of a loved one is heavy enough without legal surprises. But when someone dies without a will or trust, California inheritance law determines who receives their assets. This process, known as “intestate succession,” can feel impersonal — and often produces results never intended.

California intestate succession is the legal process that determines how a deceased person’s assets are distributed when they die without a will or trust. Under California law, the estate is distributed to the closest relatives according to a specific hierarchy: first to the surviving spouse and children, then to parents, siblings, and then to more distant relatives if necessary.

Imagine a default playlist on a music player. If you don’t create your own playlist, the player automatically plays songs based on a preset order. Similarly, if someone dies without a will, California’s intestate succession laws act like that default playlist, distributing assets according to a predetermined order of relatives, regardless of personal preferences.

As an estate planning attorney, I’ve seen children and step-parents pushed into court battles, homes lost because of probate, and families divided by rules they never knew existed. The good news is that understanding California intestate succession now can help you make choices that protect your loved ones from unnecessary conflict.

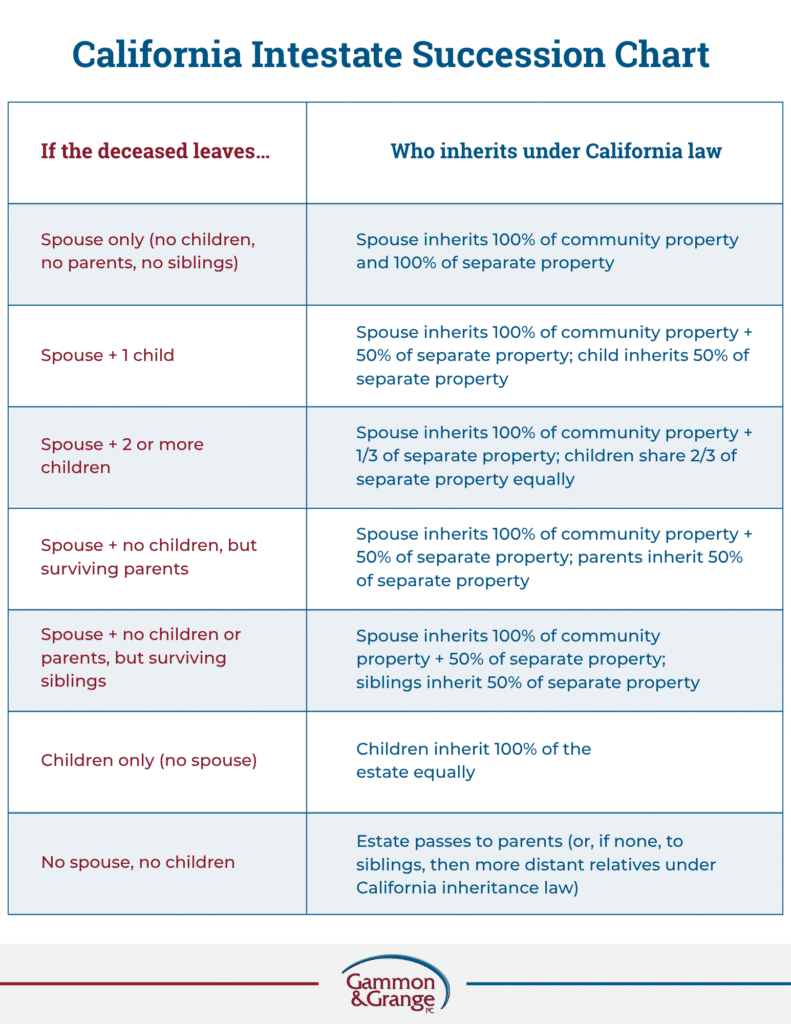

California Intestate Succession Chart

When someone dies without a will, California applies a strict order of inheritance. Our California intestate succession chart explains this in greater detail.

A couple of definitions might be helpful:

Community Property: Generally, community property refers to assets acquired by either spouse during a marriage, presumed to be jointly owned by both spouses (50/50). Think of community property like a joint bank account where both partners deposit their earnings. Everything added to the account during the marriage belongs equally to both at death or divorce, regardless of who earned it.

Separate Property: Separate property includes assets owned by one spouse before marriage or acquired individually through gifts or inheritance. Separate property is like a personal savings account that one spouse had before the marriage. Any gifts or inheritances deposited into this account remain solely theirs at death or divorce, separate from the joint finances.

On paper, this looks orderly. In real life, and without estate planning, it can often lead to heartbreak and confusion.

Complex Family Situations and Intestate Succession in California

Intestacy laws don’t account for love, loyalty, or life circumstances. I’ve witnessed many difficult scenarios like:

- Children from a first marriage forced to split the inheritance with a step-parent they barely knew

- A remarried spouse unintentionally disinheriting their own children because assets weren’t updated

- Stepchildren completely cut out of the inheritance, even when they were part of the family for decades

- Children with addiction or debt issues inheriting outright, with no protections in place.

- Families forced to navigate probate because of poor or no estate planning.

Family dynamics can be very complicated. Yet, in scenarios like these, the law treats everyone according to formula — not according to your wishes. The only legally binding way to make your wishes known is through a will or a trust.

California Inheritance Law with a Will (and a Trust)

Having a will allows you to name heirs and guardians and set basic instructions. But here’s the truth: a will alone doesn’t ensure that your heirs will avoid probate.

If your estate includes more than $208,850 in personal property or $750,000 in real estate, it will likely go through probate — even with a will. Probate is:

- Public and anyone can access your will and see your beneficiaries’ names and addresses.

- Expensive, fees can easily exceed $30,000 for an average estate.

- Slow: The process can drag on for years.

A revocable living trust is a far stronger tool. It keeps your estate private, avoids probate, and gives you control over how and when assets are distributed, provided that assets have been properly titled in a trust’s name. For families, that means less stress, fewer costs, and greater peace of mind.

California Intestate Succession FAQs

Who inherits in California if no will?

If someone dies without a will in California, their property passes through intestate succession. A surviving spouse inherits all community property and a portion of separate property. Children, parents, siblings, and other relatives may also inherit, depending on who survives the deceased.

What is the hierarchy of intestate succession?

California follows a strict hierarchy for intestate succession:

Spouse and children inherit first.

If no children, parents inherit.

If no parents, siblings inherit.

If no siblings, inheritance can pass to more distant relatives like nieces, nephews, or grandparents.

What is the next of kin order after death in California?

“Next of kin” generally follows the intestate succession rules: spouse → children → parents → siblings → extended family. Stepchildren are not automatically included unless legally adopted.

Who qualifies for kin care in California?

“Kin care” usually refers to employment law, not inheritance. Under California’s labor laws, employees can use their sick leave to care for family members — including children, parents, grandparents, grandchildren, siblings, and spouses. It does not determine inheritance rights, but it’s often confused with succession laws.

Final Thoughts

I’ve seen the fallout when someone dies without a will or trust. Families end up in courtrooms instead of around the holiday table. Inheritances are consumed by legal fees. Grieving spouses or children are left with stress they never should have faced.

That’s why I chose this work: to help families avoid these outcomes. Certainty and control are two ingredients for peace of mind. Without a plan, the courts decide. With the right plan, you decide.

While online tools may seem convenient, they often leave dangerous gaps. Working with a California estate planning attorney ensures your documents are not only valid, but tailored to your family’s unique needs. At Gammon & Grange, we consider it an honor to walk with you through this process and help secure the legacy you want to leave.