TYSONS OFFICE

A Big Tax Credit Hidden in the One Big Beautiful Bill

Finding opportunities to meaningfully reduce taxes hidden in big new federal laws is like finding Easter eggs! Beginning in 2027, a lesser-known provision of the One Big Beautiful Bill Act (OBBBA) introduces a new federal tax credit tied to charitable donations supporting K–12 education.

For taxpayers who plan ahead in 2026, this new credit may offer a way to support education while also reducing federal income taxes through donations to Scholarship Granting Organizations (SGOs). To learn more about SGOs, read our blog: What is an SGO?

Understanding that tax credits are deductions on steroids underscores why this upcoming credit may warrant a closer look.

Why Tax Credits are More Valuable Than Deductions

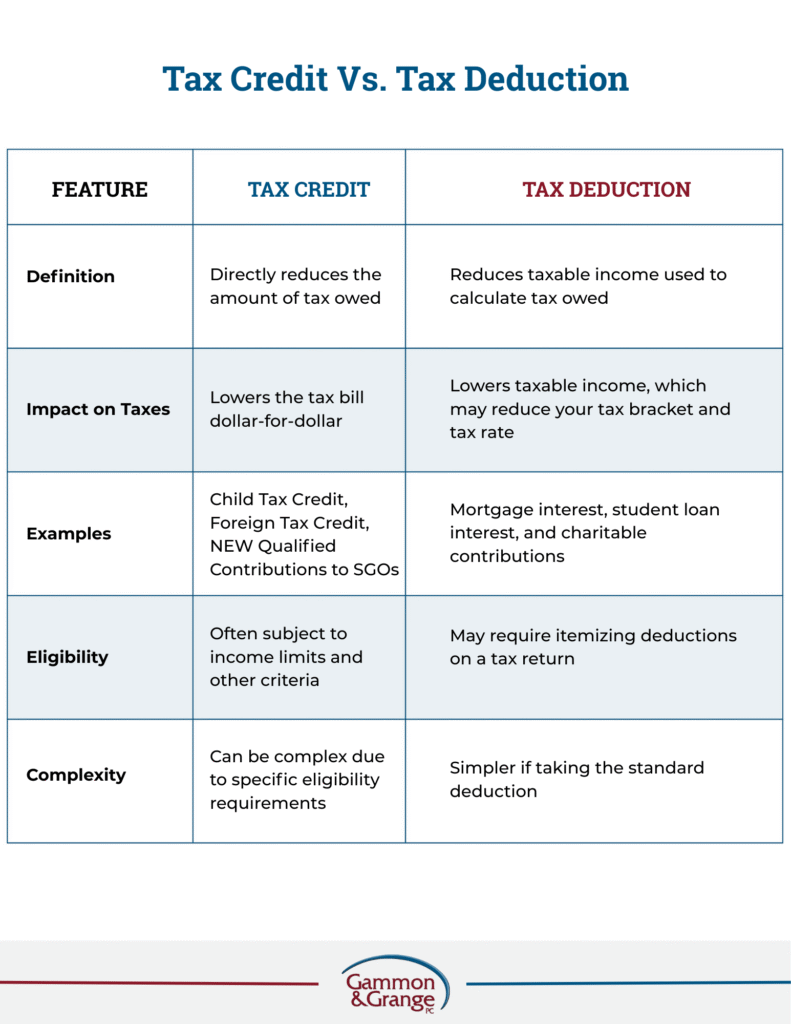

Tax credits are often confused with tax deductions, but the difference is meaningful.

A tax credit reduces the amount of tax you owe dollar-for-dollar, and may be refundable or nonrefundable. A tax deduction, on the other hand, reduces your taxable income, usually resulting in a smaller tax benefit. For Americans with a goal of 0 tax liability, tax credits like these can help you get there. The chart below highlights these distinctions.

To put this into real terms, consider this scenario:

Example Scenario:

- Taxpayer income: $100,000

- Tax rate: 25%

- Available tax credit: $1,700

- Available tax deduction: $1,700

Tax Credit Result:

- Calculation of initial tax owed: $100,000 income × 25% tax rate = $25,000 tax owed

- Calculation after application of tax credit: $25,000 tax owed − $1,700 tax credit = $23,300 final tax owed

Tax Deduction Result:

- Calculation of taxable income after tax deduction: $100,000 income − $1,700 deduction = $98,300 taxable income

- Calculation of tax owed on reduced income: $98,300 taxable income × 25% tax rate = $24,575 final tax owed

Bottom line:

A $1,700 tax credit reduces taxes by the full $1,700.

A $1,700 deduction reduces taxes by only $425.

This is why tax credits—when available—are so powerful.

How the New SGO Nonrefundable Tax Credit Works

Beginning with the 2027 tax year, individuals may be eligible for a nonrefundable federal income tax credit of up to $1,700 per year for cash contributions made to qualifying Scholarship Granting Organizations (SGOs) in participating states.

An SGO is a 501(c)(3) charitable organization that awards scholarships for qualified elementary or secondary education expenses. While SGOs have existed at the state level for years, the OBBBA creates a new federal SGO tax credit tied to donations made to these organizations.

This federal program depends on state participation. States must opt in and publish approved SGO lists. States may make an advance election by submitting Form 15714. Please encourage your governor to do so.

Key Requirements for SGOs

To qualify under the federal program, SGOs must meet specific requirements, including:

- Award scholarships to at least 10 students, who do not all attend the same school

- Use at least 90% of income to fund scholarships for eligible students

- Limit scholarships to qualified elementary and secondary education expenses

- Prohibit earmarking donations for specific students

- Verify and limit awards to students from households earning no more than 300% of Area Median Gross Income (AMGI)

- Comply with IRS self-dealing and private benefit rules

An SGO may be a newly formed nonprofit or an existing organization that meets these requirements.

Who Should Be Paying Attention to the 2027 SGO Tax Credit Now?

Although the federal tax credit tied to SGOs does not take effect until 2027, the groundwork is being laid now. The following groups may benefit from paying attention early:

Individuals and Families

This is a wonderful opportunity for individuals and families to make meaningful donations that directly reduce federal tax burdens while supporting school choice and religious schooling. While many details will continue to develop in 2026, early awareness can help you plan ahead as states decide whether to participate. Unfortunately, businesses are not yet entitled to this credit.

Schools, Nonprofit Leaders, and Visionaries

For schools, nonprofit organizations, foundations, and education-focused groups, the SGO framework may present an opportunity to expand charitable activities and offer donors a meaningful federal tax incentive. To stay informed on ways to support this initiative in your state, watch out for forthcoming Gammon & Grange blog posts on this topic.

Planning Ahead

Because the federal tax credit depends on state opt-in and evolving IRS guidance, thoughtful planning is essential. Structuring an SGO—or deciding whether to donate through one—raises both tax and nonprofit governance considerations.

Working with an experienced tax attorney and nonprofit lawyer can help clarify eligibility, compliance obligations, and strategic options as the rules continue to develop. If you would like assistance evaluating whether an SGO strategy may be appropriate for you or your organization, Gammon & Grange welcomes the opportunity to help you think through next steps. Please contact me, Jennifer Kim Nguyen, for assistance. Such initial and introductory conversations are always without charge.

This blog provides general information about tax and related topics and is for informational purposes only. It is not legal advice, does not create an attorney-client relationship, and should not be relied upon to make decisions about your specific situation. Readers should consult an attorney or other appropriate professional for advice tailored to their particular facts and circumstances.

Tax laws and thresholds change, and application of the law depends on individual facts; for guidance on your situation, please confirm current figures and seek personalized legal counsel from a licensed professional in your jurisdiction.